Navigating the Changing UK Non-Domiciled Landscape. Redefining Global Wealth: The Rise of Mauritius and UAE as Trusted HNWI Jurisdictions

As the UK government moves to abolish the long-standing non-domiciled (non-dom) tax status, wealthy individuals are re-evaluating their options for wealth preservation, succession planning, and tax efficiency.

In light of these changes, international jurisdictions such as Mauritius and the United Arab Emirates (UAE) are gaining traction as attractive destinations—not only for their advantageous tax regimes but also for their robust financial ecosystems, strategic locations, and business-friendly environments.

What Is the UK Non-Dom Status?

The UK’s non-domiciled status historically allowed individuals who live in the UK but are not “domiciled” there to limit their exposure to UK tax on foreign income and gains. They could opt for the “remittance basis” of taxation, paying UK tax only on foreign income and capital gains they brought into the country.

This system, which has been a cornerstone of tax planning for wealthy international individuals residing in the UK, is now undergoing fundamental reform.

The Shift: New Income Taxation Rules

The UK government has announced that starting April 2025, the non-dom regime will be replaced with a residence-based taxation model.

Under this model, individuals will be taxed on their worldwide income and gains once they become UK tax residents, regardless of domicile status.

Transitional reliefs will be offered, but the core message is clear: the UK is closing the door on one of its most significant tax privileges.

This shift is prompting high-net-worth individuals to look beyond UK borders to re-structure their personal and corporate affairs.

Where Are Wealthy Individuals Looking Now?

As the UK tightens its tax net, several jurisdictions are emerging as viable alternatives for wealth protection and financial optimization.

These include:

- Switzerland

- Monaco

- Singapore

- Mauritius

- United Arab Emirates (UAE)

While all these jurisdictions offer financial and lifestyle benefits, Mauritius and the UAE stand out for their flexible residency

programmes, favourable tax treaties, and expanding financial service sectors.

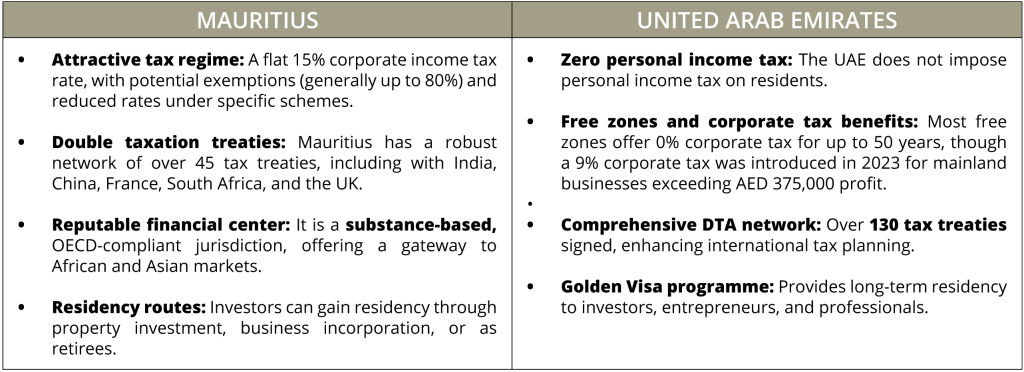

Spotlight on Mauritius and the UAE

Mauritius, an ex British colony, and the UAE, a former British protectorate, provide unique and compelling value propositions:

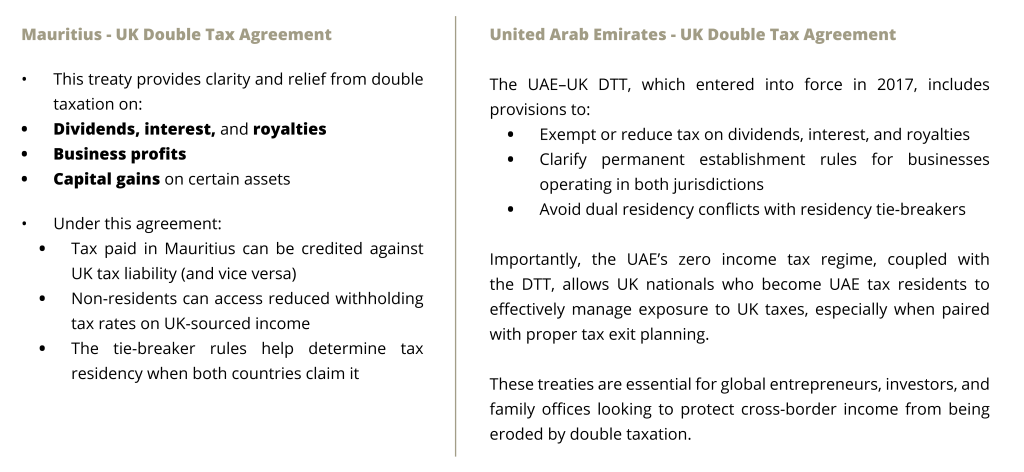

The Role of Double Tax Treaties: Avoiding Tax Duplication

For individuals and companies transitioning away from the UK, double tax treaties (DTTs) play a crucial role in preventing the same

income from being taxed twice.

Residency vs Tax Residency: Understanding the Difference

It’s also critical to distinguish between legal residency and tax residency:

- Legal residency refers to the right to live in a country based on immigration laws (e.g., through an investor visa).

- Tax residency is determined by a country’s tax laws, often based on physical presence (183 days) or economic ties.

In both Mauritius and the UAE, structured planning can align legal residency with tax residency, offering individuals the ability to

lawfully reduce global tax exposure while maintaining full compliance.

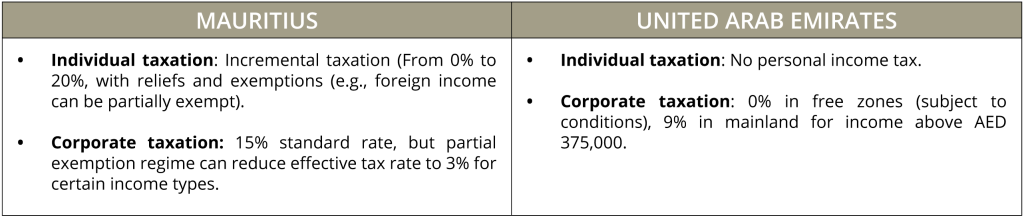

How Are Companies and Individuals Taxed?

Beyond Taxes: Why Mauritius and the UAE Are Ideal for Wealthy Individuals

While tax optimization remains a central factor, these jurisdictions offer much more:

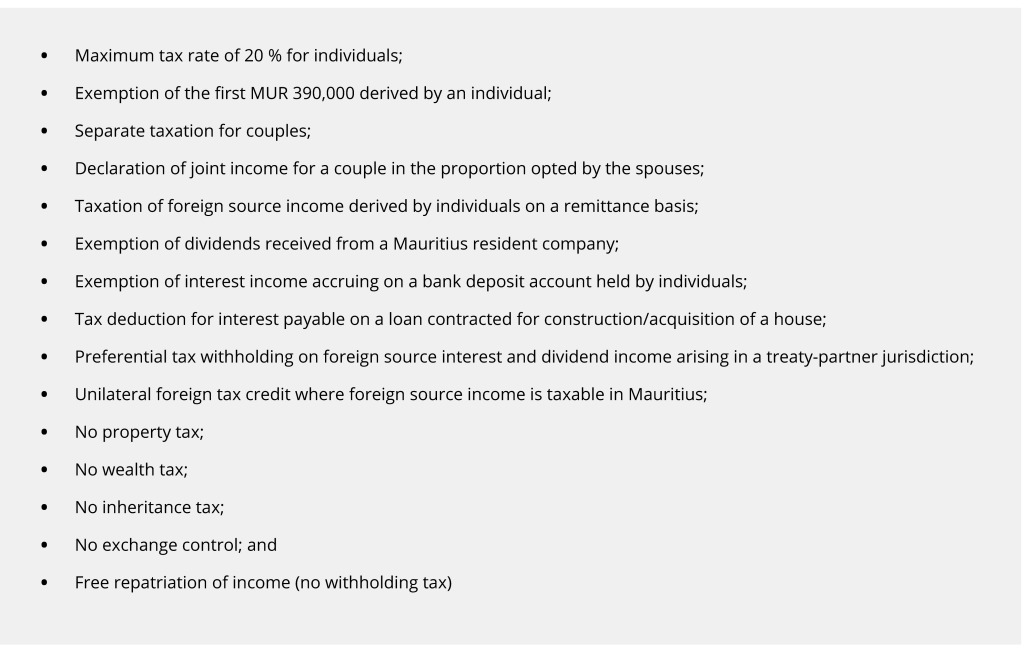

Mauritius tax landscape for individuals

JURISTAX:

A Trusted Partner in Global Wealth Structuring

For over 17 years, JurisTax has been a leading advisory and fiduciary partner, assisting wealthy individuals and families in navigating the complexities of global structuring, tax residency planning, and compliance.

With offices in Mauritius, the UAE, Singapore, India, Rwanda and Delaware, and a presence in key markets like South Africa, China, Hong Kong and the UK we offer tailor-made solutions to help clients preserve and grow their wealth across generations.

Our Services include:

As the global landscape evolves, JurisTax remains committed to providing strategic insight and local expertise—helping our clients confidently embrace new opportunities in Mauritius, the UAE, and beyond.